Although we are not yet at the end of March, there have been a few residential property market updates worth knowing about. We have summarised the data below:

Property market price resilience is starting to recover

- According to early March figures from Rightmove, property price is on the rise. It is mild but we will take that! Rather than going up by the usual 1%, this March the uptick is 1.5%. It also goes in line with the RICS survey findings last week which show a lot more market confidence in the coming months. The two pieces of insight that Rightmove offered are:

- “London saw the biggest increase in buyer demand – overall and for top-of-the-ladder properties – compared with this time last year.” If you are interested in London borough level data, you can find it in this article.

- “Agents are reporting that buyers are quickly cherry-picking attractively priced properties, while overpriced ones are taking much longer, pushing up the average time taken to sell.” This have been the trend throughout 2023, though.

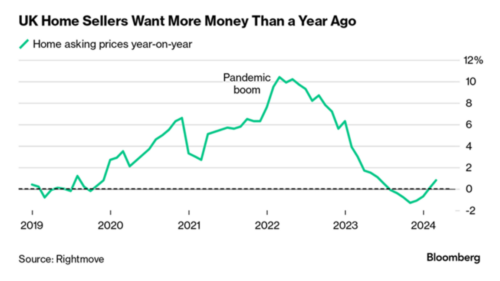

Bloomberg has done us a nice graph to illustrate the price changes and aptly pointed out that the avg. property price rises are coming from the seller side, not the buyers:

💡 INSIGHT:

But why is the market showing a bit of urgency when the mortgage rates are still high? Last week in a different article about London Bloomberg suggested that one of the key drivers is fear. People fear that property prices will jump as soon as mortgages rates start to come down and they will be priced out of the market once again.

Other property news offers additional context

- According to English Housing Survey, “the bank of mum and dad” is funding significantly more first-time buyer homes than last year. The numbers have increased from 27% to 37% YoY. But it is not as simple as that. Not all first-time buyers like the idea of relying on their parents for getting on the property ladder as it links to feelings of shame, inadequacy, and failure, especially for those with higher paying jobs. This article from The Guardian is giving some buyer opinions with a research study soundbite at the end. While these feelings do not change the buyer’s financial realities, it is important to understand that going to parents for money is not an easy choice for some. That also results in other economic phenomena, such as parents retiring later to be able to help their children save for a deposit.

- For the time being, affordability remains to be the biggest pressure. Last week TSB reported that the avg mortgage term has increased to 32 years. Simultaneously, Halifax has capped working age on mortgages at 70, which is a drop from previously used 75 years. This shows that while buyers need longer term mortgages to afford the properties with higher interest rates, the banks are being cautious about this trend too.

- New Bank of England data came out last week which showed a slight increase in property arrears. While this was the most reported learning, some eagle-eyed journalists noticed that it is not the most significant one: John Stepek posted on X that “buy-to-let now down to just 7% of gross new lending, lowest since 2010.”